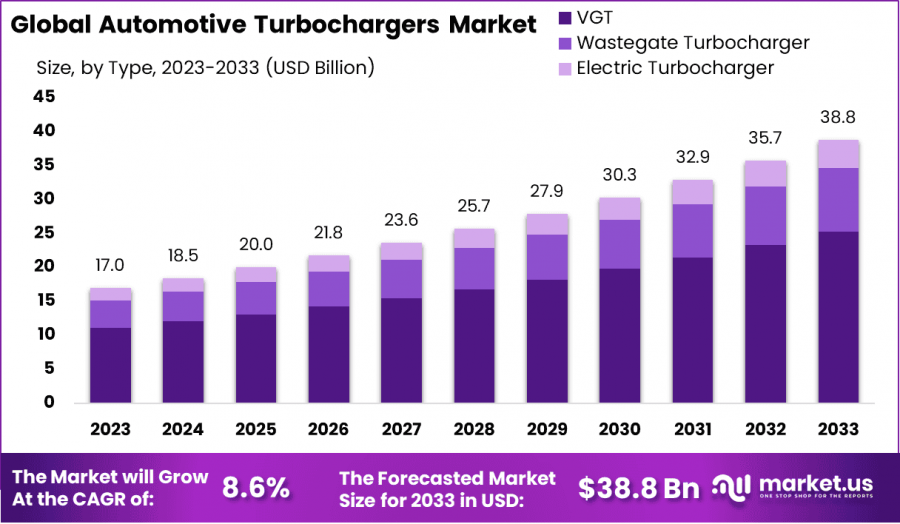

Automotive Turbochargers Market Size Expected to Hit USD 38.8 Billion by 2033, Growing at a CAGR of 8.60%

Automotive Turbochargers Market is projected to reach USD 38.8 Billion by 2033, growing at a CAGR of 8.60% from 2024 to 2033.

NEW YORK, NY, UNITED STATES, January 28, 2025 /EINPresswire.com/ -- **Report Overview**

The Global Automotive Turbochargers Market is projected to reach USD 38.8 billion by 2033, up from USD 17.0 billion in 2023, reflecting a compound annual growth rate (CAGR) of 8.60% from 2024 to 2033.

Automotive turbochargers are critical components designed to increase the efficiency and performance of internal combustion engines. By utilizing exhaust gases to drive a turbine that compresses the intake air, turbochargers enable an engine to deliver more power without increasing engine size. This technology is particularly beneficial in improving fuel efficiency, reducing emissions, and enhancing engine performance. In modern vehicles, turbochargers are increasingly employed in both gasoline and diesel engines, particularly in smaller, more fuel-efficient models, to meet stringent regulatory standards while maintaining high power output.

The automotive turbochargers market refers to the global industry involved in the design, manufacturing, and distribution of these components for passenger cars, commercial vehicles, and electric vehicles. The market has witnessed significant growth driven by the automotive industry's increasing focus on reducing carbon emissions, improving fuel economy, and meeting stricter emission norms set by governments worldwide. Moreover, the ongoing trend of downsizing engines while maintaining or enhancing performance levels has further fueled demand for turbocharged engines.

Request Your Sample Report Today for In-Depth Insights and Analysis at https://market.us/report/automotive-turbochargers-market/request-sample/

Key growth factors for the automotive turbochargers market include the growing emphasis on sustainability and environmental regulations, the rising adoption of fuel-efficient vehicles, and advancements in turbocharger technology. Additionally, the increasing penetration of turbochargers in electric vehicles (EVs) and hybrid vehicles presents a major opportunity for market expansion. As consumers and manufacturers increasingly prioritize efficiency and performance, the demand for innovative turbocharging solutions is expected to rise, fostering new opportunities for industry players. The market is also poised for growth through ongoing research and development in turbocharger materials and designs, enabling higher efficiency and better integration with next-generation powertrains.

**Key Takeaways**

~~ The global automotive turbochargers market is projected to reach USD 38.8 billion by 2033, up from USD 17.0 billion in 2023, growing at a CAGR of 8.60% from 2024 to 2033.

~~ Variable Geometry Turbochargers (VGT) lead the market with a 65.3% share, owing to their high efficiency and adaptability. Other notable segments include Wastegate Turbochargers and Electric Turbochargers.

~~ Gasoline turbochargers dominate with 52.7% market share, favored for their versatility and compliance with emission standards. Diesel and Natural Gas are also significant segments.

~~ Passenger Cars hold the largest market share at 64.4%, driven by strong consumer demand and ongoing technological advancements.

~~ Cast Iron holds the majority market share at 58.8%, valued for its durability and cost-effectiveness, while Aluminum, known for its lighter weight and better thermal properties, is gaining traction.

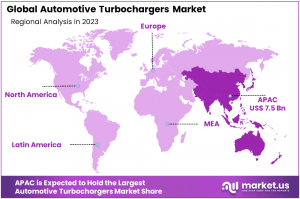

~~ Asia-Pacific (APAC) leads the global market with a share of 44.2%, driven by rapid industrialization, automotive production, and stringent environmental regulations.

**Market Segmentation**

The turbocharger market is primarily led by Variable Geometry Turbochargers (VGT), which account for 65.3% of the market due to their superior efficiency and adaptability to different engine conditions. VGTs optimize performance across both low and high speeds, making them ideal for modern automotive engines that need to balance power and emissions. Other segments include Wastegate Turbochargers, known for their simplicity and cost-effectiveness, and Electric Turbochargers, which are gaining traction for their ability to reduce turbo lag and enhance energy recovery, especially in hybrid and high-performance vehicles. As the automotive industry shifts towards electrification, electric turbochargers are expected to grow, potentially reshaping the market.

Gasoline engines dominate the automotive turbocharger market with a 52.7% share, driven by their widespread adoption and increasing compatibility with turbocharging for improved efficiency and compliance with stringent emission standards. While diesel engines, known for higher torque and efficiency, remain significant, they are facing challenges due to tighter emissions regulations and a shift toward cleaner alternatives. Natural gas engines, though smaller in share, are growing, particularly in commercial and public transport sectors, due to their lower emissions and operating costs, aligning with urban environmental goals.

The automotive turbochargers market is primarily driven by passenger cars, which hold a dominant 64.4% market share due to high consumer demand for fuel-efficient and high-performance vehicles. Turbochargers are increasingly integrated into passenger cars to boost engine performance while meeting stringent emissions regulations. While passenger cars lead the market, Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs) also contribute significantly. LCVs benefit from turbochargers for better fuel efficiency and load capacity, while HCVs, including trucks and buses, rely on turbochargers for long-haul performance and compliance with environmental standards.

Cast iron dominates the automotive turbochargers market with a 58.8% share, driven by its durability, cost-effectiveness, and ability to withstand extreme temperatures and pressures. While aluminum, favored for its lightweight and good thermal properties, is gaining traction in high-performance and luxury vehicles, cast iron remains the preferred choice for most applications due to its robust material properties and lower cost. The demand for lighter materials in advanced vehicle technologies will likely boost aluminum usage, but cast iron’s combination of performance and affordability will keep it at the forefront of the market.

**Key Market Segments**

By Type

~~ VGT

~~ Wastegate Turbocharger

~~ Electric Turbocharger

By Fuel Type

~~ Gasoline

~~ Diesel

~~ Natural Gas

By Vehicle Type

~~ Passenger Cars

~~ Light Commercial Vehicles (LCV)

~~ Heavy Commercial Vehicles (HCV)

By Material

~~ Cast Iron

~~ Aluminum

**Driving factors**

Increasing Demand for Fuel Efficiency and Emission Reduction

The growing emphasis on fuel efficiency and stringent emission regulations are major drivers of the global automotive turbochargers market. Turbochargers allow vehicles to achieve better fuel efficiency while reducing emissions, aligning with global environmental standards. This is particularly critical as automakers strive to meet regulatory requirements and consumer demand for greener, more sustainable vehicles. The push toward electrification and hybrid vehicles is also boosting turbocharger adoption, enhancing engine performance without compromising on environmental impact.

"Order the Complete Report Today to Receive Up to 30% Off at

**Restraining Factors**

High Cost of Turbocharger Installation

A significant restraint on the global automotive turbochargers market is the high cost associated with the installation and maintenance of turbocharger systems. Although turbochargers provide significant benefits in terms of performance and fuel efficiency, the added expenses can be a barrier for certain vehicle segments, particularly in emerging markets. Moreover, the complex nature of turbocharger systems requires specialized maintenance, further increasing the overall cost for consumers and manufacturers, limiting broader adoption.

**Growth Opportunity**

Growing Electric Vehicle (EV) Market

As the electric vehicle market continues to expand, there is an emerging opportunity for turbochargers to be integrated into hybrid vehicles, providing additional power and efficiency. Turbochargers can be used to enhance the performance of hybrid powertrains, enabling the internal combustion engine to work more efficiently while maintaining low emissions. This creates a market niche for turbochargers in hybrid vehicle models, offering substantial growth potential as the global EV adoption accelerates in the coming years.

**Latest Trends**

Rising Adoption of Small and Compact Turbochargers

One of the prominent trends driving the automotive turbochargers market is the increasing adoption of small and compact turbochargers. Automakers are increasingly focusing on optimizing engine performance in smaller, more efficient engines to meet fuel efficiency targets without sacrificing power. Smaller turbochargers allow for better engine downsizing, making them ideal for compact vehicles, which are becoming more popular due to their fuel efficiency and cost-effectiveness. This trend is set to continue as environmental regulations tighten.

**Regional Analysis**

Lead Region: Asia-Pacific with Largest Market Share in Automotive Turbochargers Market (44.2%)

The global automotive turbochargers market is experiencing significant growth across all regions, with Asia-Pacific dominating the market, holding a substantial share of 44.2% in 2023, valued at USD 7.5 million. This region is driven by the growing automotive production, increasing demand for fuel-efficient vehicles, and rising adoption of turbochargers in both passenger and commercial vehicles.

In North America, the market is bolstered by a high demand for performance vehicles and strict emission regulations, contributing to a steady growth trajectory. The region's market share is expected to continue rising with an increasing focus on hybrid and electric vehicle adoption.

Europe remains a key player due to its established automotive industry, especially in countries like Germany, France, and Italy, where automotive technology is advanced. The market is supported by an increasing shift towards environmentally-friendly vehicles and stringent emission norms.

The Middle East & Africa region is witnessing gradual growth, driven by a rising automotive demand in emerging markets, though it remains a smaller segment compared to Asia-Pacific and North America.

Latin America also shows promising growth, with increasing automotive production in countries like Brazil, yet its market share remains limited compared to more mature regions.

!! Request Your Sample PDF to Explore the Report Format !!

**Key Players Analysis**

The global automotive turbocharger market in 2024 is characterized by the strong presence of key players such as Garrett Motion, Continental GT, and Aptiv PLC, each focusing on enhancing fuel efficiency and reducing emissions through innovative turbocharging solutions. Garrett Motion stands out with its leadership in high-performance and aftermarket turbochargers. Continental GT continues to push boundaries with its advancements in integrated turbocharging systems for electric vehicles. Companies like ABB, Cummins Inc., and Robert Bosch GmbH are expanding their portfolios with hybrid and electrified turbocharger systems, while Turbonetics, Precision Turbo, and Mahle offer high-performance solutions for sports and commercial vehicles. This competitive landscape drives the market’s growth and technological evolution.

Top Key Players in the Market

~~ Garrett Motion

~~ Continental GT

~~ Aptiv PLC

~~ Turbonetics

~~ ABB

~~ Cummins Inc.

~~ Ningbo Motor Industrial Co. Ltd.

~~ Precision Turbo and Engine Inc.

~~ Robert Bosch GmbH

~~ Mahle

~~ Rotomaster International

~~ Mitsubishi Heavy Industries. Ltd

**Recent Developments**

~~ In March 2024, Hyundai launched the Venue Executive Turbo variant in India with an ex-showroom price of Rs 9.99 lakh. The new variant makes the turbocharged petrol engine more affordable, becoming the new base variant. The S(O) turbo variant also received updates, including an electric sunroof.

~~ In March 2024, Spiffy acquired NuvinAir, a leader in automotive air quality solutions. The acquisition expands Spiffy's offerings, providing more comprehensive vehicle maintenance and repair services.

~~ In February 2024, Maruti Suzuki launched the Fronx Turbo Velocity Edition in India, adding cosmetic updates and offering 16 accessories. The edition is available for Delta+, Zeta, and Alpha variants for an additional Rs 43,000.

~~ In January 2024, Porsche launched the Macan S EV Turbo in India at Rs 165 crore. This all-electric SUV features a dual-motor setup delivering 617 bhp and 1020 Nm of torque, accelerating from 0 to 100 km/h in 3.8 seconds with a top speed of 250 km/h.

~~ In June 2023, Mazda launched new carbon turbo variants for the Mazda3, CX-30, and CX-5, featuring a 2.5-liter turbocharged engine that produces 250 horsepower and 320 lb-ft of torque, available in both front-wheel-drive and all-wheel-drive configurations.

**Conclusion**

The global automotive turbochargers market is projected to reach USD 38.8 billion by 2033, growing at a CAGR of 8.60% from 2024 to 2033. This growth is driven by increasing demand for fuel-efficient vehicles, stringent emissions regulations, and the rising adoption of turbochargers in both traditional and electric vehicles. Variable Geometry Turbochargers (VGT) lead the market, while gasoline-powered vehicles dominate in terms of fuel type. Asia-Pacific holds the largest market share, fueled by rapid industrialization and automotive production. Despite challenges like high installation costs, the market is expanding due to ongoing technological advancements, with key players such as Garrett Motion, Continental GT, and Aptiv PLC at the forefront, focusing on improving fuel efficiency and performance. Additionally, the growing electric vehicle market presents a significant growth opportunity for turbochargers in hybrid vehicles.

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Automotive Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release